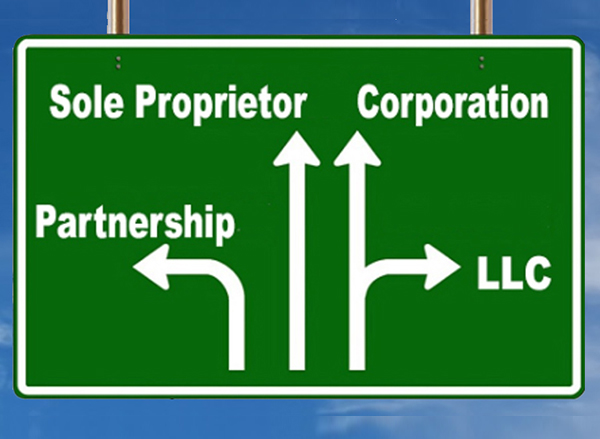

Starting is a business is not easy. Apart from the many decisions that you need to make, one important decision is to select a business entity for your company. An entrepreneur needs to be very clear about choosing a business entity as this decision will affect your taxes you pay, your growth plans and even your ability to raise money. While choosing a legal or business entity, you should be very clear about-

- The kind of work you are going to do

- Under what government or taxation norms does it fall into?

- How can I seamlessly fulfill my future business requirements

- Only after selecting a business entity, you can register your business with the state

- One of the most easily formed entities is sole proprietorship as both, the managerial control & financial liabilities remain with the owner

- If you want to be your own boss and don’t want to enter the hassle of having multiple partners or too many obligations, then this is the best decision for you

- It’s simple and cheap, you can think of the business structure. The only fee you need to pay is license fee and taxes

- Under a sole proprietorship, you are entitled to some tax deductions as well

- This business entity is run by two or more people together who have a share in profits as well as loses too

- This kind of an arrangement is ideal if you want to start a business with a family member, friend or a business partner where all share the profits and losses and are involved in making important decisions regarding the business

- General Partnership- In this arrangement, all profits and losses are shared equally

- Limited partnership- Limited partnerships have one partner with unlimited liability, and all other partners have limited liability

- You work as a team. Partners are in the business not only to share the profits but also to share the challenges that come along during setting up a business. Ideas can be shared and learning from each other is natural.

- However one should only enter a partnership when you can work in tandem with another person and accept that the profits are not solely your profits!

3. Limited Liability Companies (LLC)

- This is a mixed structure business entity that allows the partners or shareholders to limit their personal liabilities but still enjoy the tax benefits of a partnership. The members of an LLC can be individuals, a partnership or a corporation

- The major benefit of an LLC that in most cases the partners are protected from personal liability the same way as shareholders are in a corporation.

- You do not need to file corporate tax as an LLC, but you need to file your profits and losses and submit it with your tax return under schedule C

- Corporations are business entities separate from their owner. It handles the responsibility of an organization and running a business

- The corporation is taxed and is also fully liable for its actions

- The benefit of forming a corporation is that it is separate from your personal liability and the disadvantage is that it is a bit costly to form this legal entity

- There are several types of corporations, such as C corporations, S corporations, B corporations, closed corporations, and nonprofit corporations. However, the S-corporation was formed for small businesses to avoid double taxation

- When your business is a corporation, the chances of you raising more capital from investors increase because funds can be raised through selling stocks which can be a luring option